Data Center Build Loan Plan

The Data Center Build Loan Plan is tailored for companies, technology providers, and public–private partnerships looking to design, construct, or expand data centers. With global reliance on cloud computing, AI, fintech, and digital services, the demand for secure, scalable, and sustainable data infrastructure is at an all-time high.

This loan plan supports businesses in financing new builds, expansions, retrofits, and modernization of data centers. From tier-3 regional facilities to hyperscale centers serving millions of users, LendRoam provides financing that enables firms to meet rising demand while complying with international standards.

The plan is denominated in United States Dollars (USD), making it aligned with global procurement, technology imports, and foreign investor benchmarks.

2. Eligibility Criteria

Borrowers must demonstrate both technical and financial readiness for high-tech infrastructure projects.

Borrower Profile:

Established ICT, telecom, or infrastructure firms.

Consortia and public–private partnerships.

Technology companies expanding into cloud and hosting services.

Requirements:

Documented business plan for facility construction or upgrade.

Technical feasibility studies and architectural blueprints.

Energy supply contracts (data centers require stable, large-scale power).

Environmental and regulatory approvals.

Audited financial records and clean credit history.

3. Loan Structure and Terms

The Data Center Build Loan is designed for capital-intensive projects with significant upfront costs.

Repayment Interval: Monthly, quarterly, or semi-annual (based on projected cash inflows).

Total Installments: Multi-year tenor, typically 6–10 years.

Repayment Model: Grace period during construction and commissioning phases → declining balance repayments once operations begin.

Application Fees: Fixed due diligence charges plus percentage-based review fees.

Penalty Model: Structured penalties for missed repayments; restructuring flexibility for technical delays.

4. Repayment Analysis (Illustrative)

Typical repayment flows for a data center project:

Construction Phase (12–24 months): Interest-only payments, allowing developers to focus on completing the build.

Operational Phase: Principal + interest repayments, supported by revenues from colocation services, cloud hosting, enterprise leasing, or wholesale agreements.

Long-Term Stability: Declining balance ensures reduced payment pressure as loan matures.

5. Use Cases / Practical Scenarios

Hyperscale Facilities

Loan supports multinational tech companies building large-scale data hubs.

Enterprise Data Centers

Financing for corporations constructing private centers for financial, healthcare, or defense data.

Regional Hosting Facilities

ICT firms expanding mid-sized centers to support SMEs and government agencies.

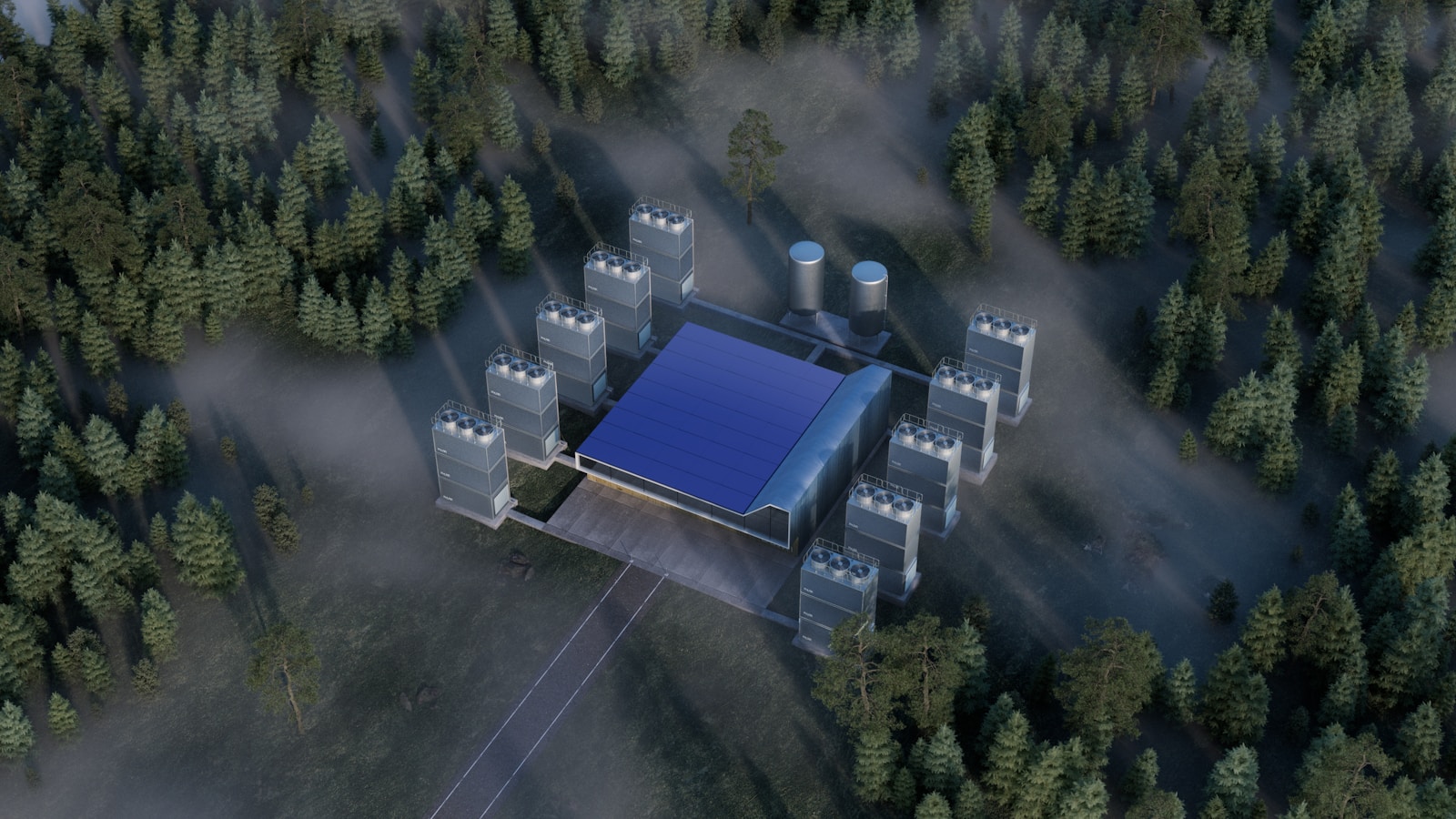

Green & Sustainable Data Centers

Loan covers renewable-powered cooling systems, energy-efficient servers, and carbon-neutral certification.

Retrofit & Modernization

Upgrading legacy data centers with new servers, improved cybersecurity, and scalable storage.

6. Benefits

Large Capital Support: Enables companies to enter or expand in high-demand digital markets.

Extended Tenor: Matches the lifecycle of digital infrastructure projects.

USD Denomination: Stability for global tech procurement.

Grace Periods: Alleviates financial stress during build and commissioning stages.

Sustainability Boost: Supports financing for energy-efficient, eco-certified designs.

7. Risks & Considerations

Construction Risks: Delays in building, power supply issues, or contractor failures.

Technology Risks: Rapid obsolescence of servers or cooling systems.

Energy Risks: Data centers are power-hungry; unstable energy supply can disrupt viability.

Cybersecurity Risks: Facilities must meet stringent compliance standards (ISO, GDPR, PCI-DSS).

Market Risks: Competition from global cloud providers may impact revenue.

8. Regulatory and Compliance Aspects

Borrowers must provide:

Environmental Impact Assessments (especially for energy use).

Cybersecurity and data protection compliance certifications.

Power purchase or supply agreements.

Regular audited accounts and project reports.

LendRoam ensures:

Independent monitoring of construction milestones.

ESG alignment for green certification.

Structured release of funds in tranches tied to progress reports.

9. Case Study (Hypothetical Example)

Business: CloudSphere Technologies Ltd.

Project: Tier-4 Data Center in West Africa.Loan Usage: Land acquisition, server procurement, advanced cooling systems, backup energy plants, cybersecurity systems.

Impact: Hosted 500 enterprise clients, supported local fintech ecosystem, attracted foreign investments.

Repayment: Structured over 8 years, with grace period during 18-month construction phase.

10. Conclusion

The Data Center Build Loan Plan is a high-impact financing product designed to power the digital economy of the future. It helps enterprises meet the surging demand for secure, scalable, and sustainable data storage and processing facilities.

By removing fixed loan amounts, this plan is scalable across small, enterprise, and hyperscale projects, making it adaptable for regional ICT firms, multinationals, and governments alike.

It combines financial stability, long-term repayment flexibility, and global credibility, ensuring that funded data centers become the digital backbone of modern economies.